General rules:

- Turn off or lock the computer you use for online banking when you are not using it (when you're out of the office or on vacation).

- Do not open emails or email attachments sent by unknown senders. We advise you to be cautious when opening emails and attachments received from known senders, as viruses commonly spread that way as well.

- Do not install any software from unknown sources on your computer.

- Never visit any websites by clicking a link in the email; always type the website URL into the search bar in your browser.

- Choose passwords that are difficult to guess, and never share your password with anyone. Keep your passwords at a safe location or remember them, and make sure to change them regularly.

- Make sure that the latest security patches, firewalls and anti-virus software are installed on your computer and run regular anti-virus scans.

- Use the latest version of your preferred web browser and operating system and update both regularly.

Rules for online banking

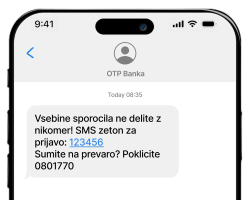

- If you don't know the person who introduces himself/herself as the bank's employee or contact center employee, or if his/her identity is not made known otherwise, make sure to ask about his/her identity.

- Bank will never request to allow remote access to your computer.

- Never send any sensitive or personal data (username, password, etc.) by email.

- Regularly check your account balance and turnover.

- Remember your username and password and do not write them down.

- If you receive an email from bank requesting sensitive or personal data, call our contact center.