When I was younger, I never thought about retirement because retirement seemed so far away. However, after 15 years of work, I calculated what kind of state pension I can expect.

I only started thinking about it when my parents retired and I saw the amount of their pensions.

![]()

A minimum percentage is set for the assessment of old-age pensions. Considering the downward trends of the latter and the increase in working years for calculating the pension base (40 years), it was clear to me that the pension base is gradually decreasing.

With the help of an investment professional, I did the math based on my income and found the following. With a net pension base of 1,000 EUR (calculated on the basis of my actual income of EUR 1,200 - including travel expenses and lunch), the calculation showed me that I would have a state pension of 635 EUR.

|

ADVICE FROM BANKING EXPERTS THAT BENEFITED ME:

|

| Based on the calculation of the expected amount of the pension, taking into account the currently valid pension legislation, we suggest saving in mutual funds, as it offers potentially higher returns and thus more saved funds at retirement. |

Considering the cost of living, which is anything but low, I have estimated that this is, unfortunately, insufficient for my needs. In the long run, I would like to ensure at least an approximately equal income between the working period, i.e. my net salary, and my pension.

I checked the range of mutual funds on OTP banka's website and decided on this type of investment, which will help me achieve my goal - to live a decent life even in retirement. I would definitely not want to be a (financial) burden to my children. At the same time, I think it is important to ensure a good basis for a quality life even when we are no longer working.

After meeting with an investment professional, I found the following. Mutual funds offer me a transparent and transparent way of monthly savings. At any moment, I have insight into the state of my saved funds (online and mobile bank). At the same time, it is a very cost-effective saving, as the entry fee is only 1.5%.

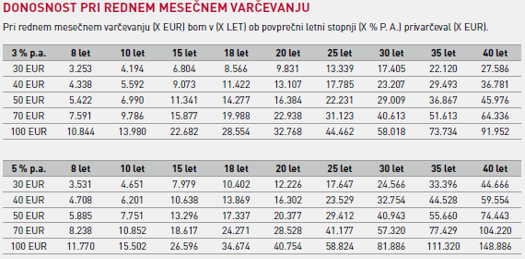

An investment expert and I calculated:

If I set aside 100 EUR per month for saving for the next 25 years, I will save 57,929.91 EUR at an estimated annual return of 5%. This means that I will be able to pay myself an additional pension of 346.59 EUR in retirement and thus make up for the pension gap.