Environmental principles

The Bank is aware that its business environment is and will be impacted by climate change. This will also have impacts on the physical and macro-economic environment in which it operates. The transition to a low-carbon or carbon-neutral economy brings with it both risks and opportunities for us (as for other financial institutions). The Bank recognizes both physical climate change and transition risk as relevant drivers of its overall risk profile.

The Bank operates in a Member State of the EU, which has committed to reducing its GHG emissions by 55% from the levels recorded in 1990 by 2030. With the European Green Deal, the EU has committed to making Europe a climate-neutral continent by 2050. In this context, Slovenia has made its own commitments in support of the EU’s binding goals (last refreshed in 2023).

The European authorities, including the European Central Bank (ECB), expect the financial sector to play a key role in this process, and the European Commission has set this out in its action plan for financing sustainable growth.

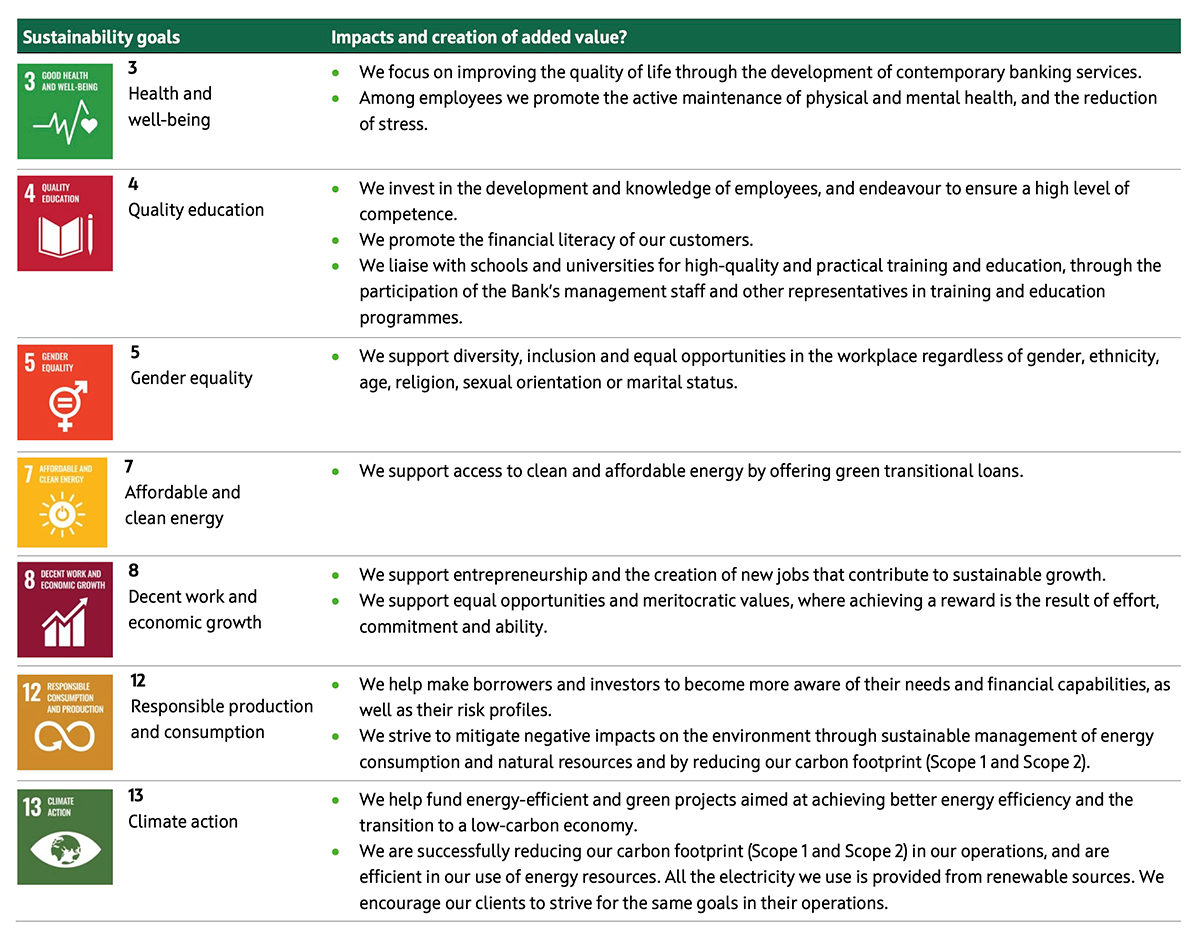

The Bank is taking actions in the short and medium term to adapt its current investment and loan portfolio to one that is aligned with the EU’s and Nationally Determined Contributions (NDCs) to decarbonize the economy, and that its exposure to climate and transition risk is reduced over time.

The Bank is taking actions in the short and medium term to increase its commitments to financing the economic transition towards a low-carbon or carbon-neutral economy.

The Bank is taking actions in the short and medium term to further reduce its own Scope 1 and Scope 2 emissions, recognizing the progress already made in this respect.

Social principles

The OTP Group Slovenia will remain a socially responsible institution, and continue to build sustainable, open, and proactive relations with all our stakeholders: employees, customers, business partners, and others. We aim to contribute to the development of the broader social and economic environment in which we operate.

We will keep supporting national, regional, and local communities as a partner, sponsor, or donor with regard to events, projects, and initiatives. We will continue with awareness-raising programs in the areas of financial literacy, which includes providing knowledge about banking products and services, responsible investing and borrowing, digital literacy, safe banking, fraud prevention, and security in online commerce.

We will continue to build an inclusive work environment that promotes equality and diversity and that prioritizes employee well-being.

Governance principles

The Group will remain committed to meeting the highest corporate governance and compliance standards. We have codified our shared values, the foundation of ethical standards and rules of conduct, in our Code of Conduct which is the primary building block of our corporate culture.

We will keep acting with full transparency and the highest level of integrity as well as continuing to have a zero-tolerance policy toward any kind of corruption in all our business relationships and transactions.